Introduction to Grayscale solana trust discount to nav

The world of cryptocurrency is constantly evolving, and with it comes exciting investment opportunities. One such opportunity lies in the grayscale solana trust discount to nav, which offers a unique discount to its net asset value (NAV). But what does this mean for investors? If you’ve been keeping an eye on Solana or are curious about entering the crypto market, understanding this discount could set you on a path toward potential gains. Let’s dive into what makes the grayscale solana trust discount to nav so appealing and explore how investing in it can benefit you as part of your financial strategy.

Understanding the Discount to NAV

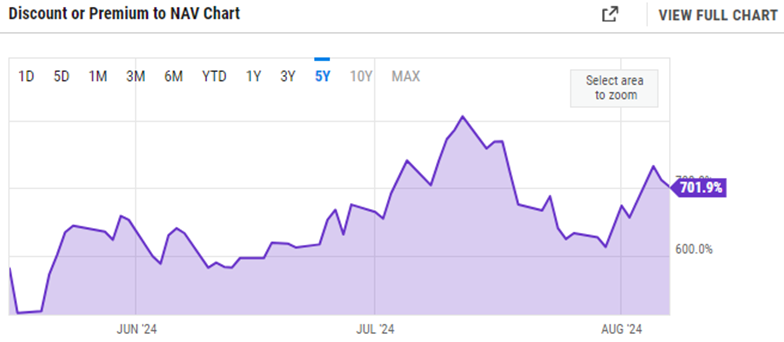

The concept of a grayscale solana trust discount to nav can be perplexing, especially in the context of investment trusts. NAV stands for Net Asset Value, which is essentially the market value of the assets held by a trust minus any liabilities.

When an investment trust trades at a discount, it means that its shares are priced lower than this calculated value. This situation often arises due to market fluctuations or investor sentiment rather than reflecting the true worth of the underlying assets.

For grayscale solana trust discount to nav, this discount presents unique opportunities. Investors might find themselves purchasing shares at a more attractive price compared to what those assets would typically command on the open market. Essentially, you’re accessing cryptocurrency exposure without paying full price for it.

Such dynamics can create potential advantages but also highlight how perception and demand influence share prices in financial markets.

Benefits of Investing in a Grayscale Solana Trust

Investing in a grayscale solana trust discount to nav brings several distinct advantages. First, it allows investors to gain exposure to the burgeoning Solana blockchain without directly purchasing and managing crypto assets.

The trust offers an accessible way for institutional and retail investors to tap into the cryptocurrency market. It simplifies entry while removing complexities associated with wallets or private keys.

Another notable benefit is liquidity. Unlike holding physical cryptocurrencies, shares of the grayscale solana trust discount to nav can be traded on public exchanges, providing more flexibility for investors looking to adjust their positions.

Additionally, by investing through this trust, individuals can enjoy professional management. This means that experts are overseeing the investment strategy and custody of assets—taking some burden off your shoulders.

Participating in a regulated investment vehicle enhances credibility, which may appeal to traditional investors who might hesitate due to security concerns surrounding digital currencies.

Diversification of Portfolio

Diversification is a key strategy in investment. By including various asset classes, investors can spread risk and enhance potential returns.

Investing in the grayscale solana trust discount to nav offers a unique opportunity to diversify beyond traditional assets. This trust allows exposure to the booming cryptocurrency market without needing to manage individual coins.

Cryptocurrencies can behave differently than stocks or bonds. Their price movements might not correlate with more conventional investments. Thus, adding a grayscale solana trust discount to nav into your portfolio could stabilize overall performance during volatile periods.

Moreover, this diversification helps mitigate risks associated with any single asset class plummeting unexpectedly. When one area struggles, another may thrive, balancing out potential losses effectively.

For those looking to broaden their financial horizons, exploring options like the Grayscale Solana Trust becomes increasingly appealing as part of a well-rounded investment approach.

Potential for Higher Returns

Investing in a grayscale solana trust discount to nav unique opportunities for higher returns. The trust holds actual Solana assets, which tend to fluctuate in value based on market demand and adoption.

As interest in blockchain technology grows, so does the potential for price appreciation. If Solana continues its upward trajectory, investors could experience significant gains compared to traditional investments.

Moreover, being part of an established investment vehicle like grayscale solana trust discount to nav adds a layer of credibility. It attracts institutional interest that can drive up demand and subsequently boost valuations.

The discount to NAV also plays into this equation. Purchasing at a lower price than the underlying asset increases your chances for profit when the market corrects itself or when sentiment shifts positively towards Solana.

This combination of factors creates an appealing scenario for those looking to maximize their investment potential while navigating the cryptocurrency landscape.

Exposure to Cryptocurrency Market

Investing in a grayscale solana trust discount to nav provides a straightforward avenue to gain exposure to the vibrant cryptocurrency market. This trust allows investors to access Solana without needing to navigate complex exchanges or wallets.

With its rapidly growing ecosystem, Solana has captured the attention of many. By investing through Grayscale, you tap into this dynamic landscape with relative ease.

The volatility that characterizes cryptocurrencies can be daunting for some, but it also presents unique opportunities for growth. The grayscale solana trust discount to nav structure helps mitigate some risks by offering professional management and oversight.

Furthermore, holding shares in the trust means you’re part of a larger movement toward decentralized finance and blockchain technology. Embracing this trend may well position your investment portfolio for future advancements in digital assets.

Lower Fees and Hassle-Free Management

Investing in a grayscale solana trust discount to nav can be an attractive option due to its lower fees. Traditional investment vehicles often come with high management costs, which can eat into your potential profits. With the Grayscale model, you benefit from streamlined operations that help keep expenses down.

Hassle-free management is another compelling aspect. Investors don’t need to worry about actively managing their investments or navigating complex trading platforms. Grayscale takes care of these logistics, allowing you to focus on your long-term strategy without constant monitoring.

This approach not only saves time but also reduces stress for investors new to the cryptocurrency space. Knowing that professionals are handling the intricacies provides peace of mind and freedom to explore other opportunities while still gaining exposure in the crypto market.

Risks and Considerations

Investing in a grayscale solana trust discount to nav offers numerous advantages, but it’s essential to recognize the associated risks. One significant concern is market volatility. Cryptocurrencies can experience sharp price swings, impacting trust performance.

Another consideration is liquidity risk. While grayscale solana trust discount to nav products are designed for institutional investors, accessing funds might not be as straightforward for individual investors during downturns.

Additionally, regulatory changes could pose challenges. The cryptocurrency landscape is constantly evolving, and new regulations can influence valuations and operational frameworks.

Always weigh your own financial goals against potential losses. Ensure that any investment aligns with your risk tolerance and overall strategy before diving in. Understanding these factors can aid in making informed decisions about investing in the grayscale solana trust discount to nav.

Conclusion:

The grayscale Solana trust discount to NAV offers a unique opportunity for investors looking to tap into the burgeoning cryptocurrency market. By understanding what this discount means and its implications, you can make informed decisions that align with your financial goals.

Investing in a grayscale solana trust discount to nav not only provides diversification but also gives you exposure to potential high returns in an emerging asset class. With the added benefits of lower fees and hassle-free management, it positions itself as an enticing option for many investors.

However, it’s essential to remain aware of the risks involved. The crypto market is volatile, and while discounts may present opportunities, they can also come with uncertainties.

Exploring these factors allows you to weigh the advantages against potential downsides effectively. As always, doing thorough research will empower your investment journey.